does cash app have overdraft protection

As a peer-to-peer P2P payment platform Square Cash must put in place limits to prevent fraud and abuse. Select Report a Payment Issue.

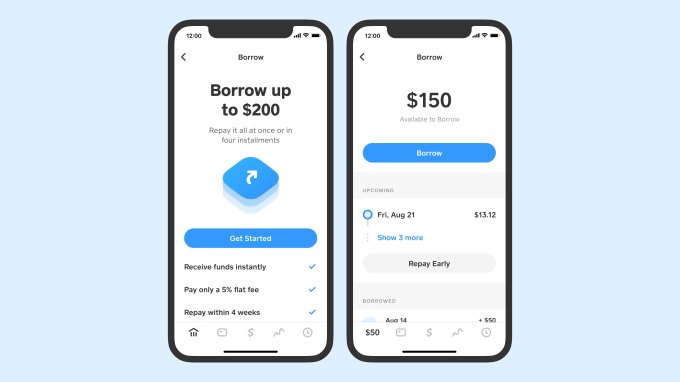

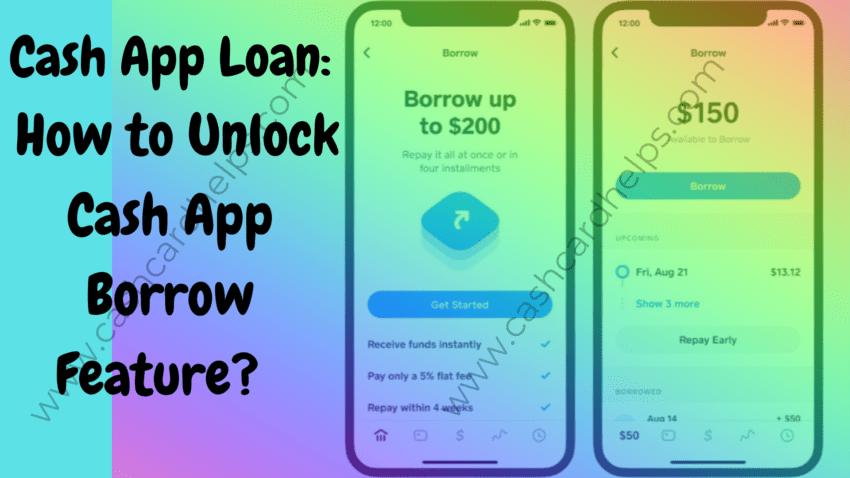

Cash App Loan How To Unlock Cash App Borrow Feature

Its common for a bank to charge.

. Call the consumer financial protection bureau at 1-855-411-2372 or cfpbgovcomplaint. This fee is waived for Chase Private Client Savings accounts and also for Chase Premier Savings accounts with a balance of 15000 or more in the account at the time of withdrawal or transfer out. Any transaction that would overdraw your account over your limit will be declined.

You can send up to 250 in a single transfer or as multiple transactions in any seven-day window before Square Cash will demand further. The best thing is that they help you avoid the frustrating overdraft fees. Cash App encrypts your data and offers security measures and fraud protection to keep your identity and money safe from thieves.

You wont pay overdraft fees if you have insufficient funds transactions will be declined. To do this simply do one of the following. I had 9 dollars in my account.

Launch the Cash App and tap on a Customer Avatar to view a profile. As mentioned in order to allow your account to overdraft you will have to opt-in for an overdraft protection. The transaction is returned unpaid and is commonly known as bouncing.

To learn more about fees when theres not enough money in your linked Overdraft Protection backup account please read How your transactions. Empower also allows users to get their paycheck up to two days faster than traditional accounts. Get a short term loan through a cash advance app.

Cash App Support ATM Withdrawal Limit. This isnt entirely true. An overdraft occurs when you dont have enough money in your account to cover a purchase check or payment.

15 fee may apply to each eligible purchase transaction that brings your account negative. Overdraft protection is a banking feature that prevents any transaction that would cause your account balance to fall below zero. Activated chip-enabled debit card and opt-in required.

Cash App utilizes a variety of safety features to process millions of payments a year and ensure the protection of our customers. Empowers cash advance of up to 250 is available for a 8 per month subscription fee. A limit requiring ID.

Cash App uses the same fraud detection. Cash App appears to be a quick convenient and secure way to send and receive funds as well as being easy and simple to navigate. However this particular user advised.

Empower is a fintech app with a Visa debit card that earns cash backand can give you access to up to 250 in cash advances. 5 Loan Apps in 2022. Log in to online banking then go to your checking account and select the Overdraft protection options link.

FDIC and SIPC. Tuesday I had a payment declined from Walmart even though I had been sitting at home. Amount you can borrow.

1000 per 24-hour period. Any information you submit is encrypted and sent to our servers securely regardless of whether youre using a public or private Wi-Fi connection or data service 3G 4G or EDGE. Security Locks PIN entry Touch ID or Face ID verification protects payments.

Brigit allows you to get money when you need it while also offering budgeting help and financial advice. Your SpotMe limit starts at 20 and can be increased up to 200 based on account history and activity. Having insufficient funds in your account to cover a transaction will usually trigger an overdraft fee.

Encryption PCI-DSS level 1 certification means we protect all your data. Cash app can not overdraft if the expense is greater than your balance it declines. Once youve decided which accounts you want your overdraft protection transfers to come from youre ready to set up overdraft protection.

Unlock overdraft protection up to 200. Fees in Cash App are minimal. Cash app transfer limit.

1000 per 7-day period. Prepaid cards with overdraft protection allow you to complete transactions that overdraw your account by as much as 10 with no penalty or fee as long as you restore sufficient funds in your account soon after the overdraft. Please note that Chime Member Services cannot manually increase your SpotMe limit.

Rockbox is among the best cash advance apps available. Based on your account history the deposits you make and the amount of the transaction we may cover it for you and charge a 34 Insufficient Funds Fee. Coin Storage Your Bitcoin balance is securely stored in our.

Best for Budgeting Tools. It can lend you up to 2500 10 times more than other cash advance apps. The app does away with common financial services costs including.

You can use your Cash Card to get cashback at checkout and withdraw cash from ATMs up to the following limits. Bank of America charges a 35 overdraft fee per transaction. Hes definitely using that money for something shady.

Details About Your Cash App Stored Balance. One helpful review in the App Store mentions that Cash App is time-saving much easier than mailing checks or money orders to family members and highly recommends the Cash Card. The Cash app has two types of transfer limit.

To receive a Gift the Recipient must have a Cash App account. ATMs that let you overdraft will allow you to withdraw cash even though you dont have enough in your account. This includes every time a check or scheduled payment attempts to go through.

Call us at 800-USBANKS 872-2657. Select the payment and follow the prompts. To get a cash advance using the app you must have a paid plan which offers cash advances automatic deposits to prevent overdraft and credit monitoring.

Most banks and credit card companies will let you do this but there are usually high fees for this service. To use your Cash Card to get cashback select debit at checkout and enter your PIN. Bank of America allows four overdrafts.

A single overdraft fee can take between 15 and 25 from your account. However in the event that you need emergency cash from an ATM and must overdraft you may avoid a fee by depositing the money before the end of the same business day. Cash advance apps like PockBox offer one of the quickest ways to get cash.

Cash App uses cutting-edge encryption and fraud detection technology to make sure your data and money is secure. Balance must be brought to at least 0 within 24 hours of authorization of the first transaction that overdraws your account to avoid the fee. If the scam is associated with a potential scam account instead of a specific payment report and block a potential scam account by following these steps.

We currently do not offer overdraft or credit features. If we dont cover the item and returned it unpaid we wont charge a fee. To use the Gift to purchase stock the Recipient must successfully open.

Cash Advances and Overdraft Protection Cash advance apps are one-time options for emergency cash but.

Why Does Cash App Have A Negative Balance Fix Cash App Negative Balance

Square S Cash App Tests New Feature Allowing Users To Borrow Up To 200 Techcrunch

Can You Overdraft Cash App And How Much Would That Cost You

Can You Overdraft Cash App Card How To Fix Overdraft Cash App Card

Cash App Overdraft Understand When Cash App Balance Go Negative

Learn About Cash App Overdraft Limit L Fix Cash App Negative Balance Cash App

Does Cash App Have A Website To Access All Its Features And Services

2022 Can I Overdraft My Cash App Card At Atm Gas Station Unitopten

How To Get 30 Free On Cash App Youtube

Cash App App How To Get Money Free Money Hack

Can You Overdraft Cash App All You Need To Know

Square S Cash App Tests New Feature Allowing Users To Borrow Up To 200 Techcrunch

Cash App Loan How To Unlock Cash App Borrow Feature